new haven house taxes

Address 165 Church St. Setting tax levies estimating values and then receiving the tax.

Tax Reform 2017 Can My Clients Deduct Property Taxes They Prepaid In 2017 Under The New Tax Law Tax Pro Center Intuit

City Of New Haven.

. Taxation of real estate must. Account info last updated on Nov 9 2022 0 Bills - 000 Total. The Tax Collector is responsible for collecting local business property and real estate tax payments also can provide information about property taxes owed and property.

Proposed a 4754 million budget for fiscal 2011-12 that holds the line on property taxes but includes cuts to city services and the possibility of more. Payments made after 8 pm on Friday-Sunday would not be posted until the following Tuesday. Revenue Bill Search Pay - City Of New Haven.

The Town is encouraging residents to mail their payments to New Haven Tax Collector PO. 1st Floor New Haven CT 06510. Office Hours Monday - Friday 900 am.

For example if the. View Cart Checkout. Each municipality then receives the tax it levied.

In addition a city-wide Phase-In was enacted for the 2021 Grand List which phased in 50 of assessment increase due to the revaluation. 2021 Grand List is 3975. New Haven County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in New Haven County Connecticut.

The median property tax in New Haven County Connecticut is 4621 per year for a home worth the median value of 273300. 1652 New Haven Ave is. The Town of New Haven is offering alternative options for making Property Tax payments.

Mayor John DeStefano Jr. Plenty of off-street parking at this house. Woodmont Borough Tax of 25739 per year.

This page is filled with customizable widgets that allow you to interact with the BSA data provided by the online and. Huge rear deck for entertaining. Flood insurance is needed.

Welcome to BSA Online powered by BSA Software. New Haven County collects on average 169 of a propertys. If you need to find your propertys most recent tax assessment or the actual property tax due on your property.

Tax Collector Email. In general there are three stages to real estate taxation. For comparison the median home value in New Haven County is 27330000.

1 be equal and uniform 2 be based on current market worth 3 have a single estimated value and 4 be held taxable in the absence of being specially. All payments made after 8 pm Monday-Thursday allow 48 hours to be posted.

8 Cross Street Newport Ri 02840 Compass

The U S City Where Property Taxes Rose The Most Last Year Will Likely Surprise You Marketwatch

Cost Of Living In New Haven Ct Taxes Housing More Upgraded Home

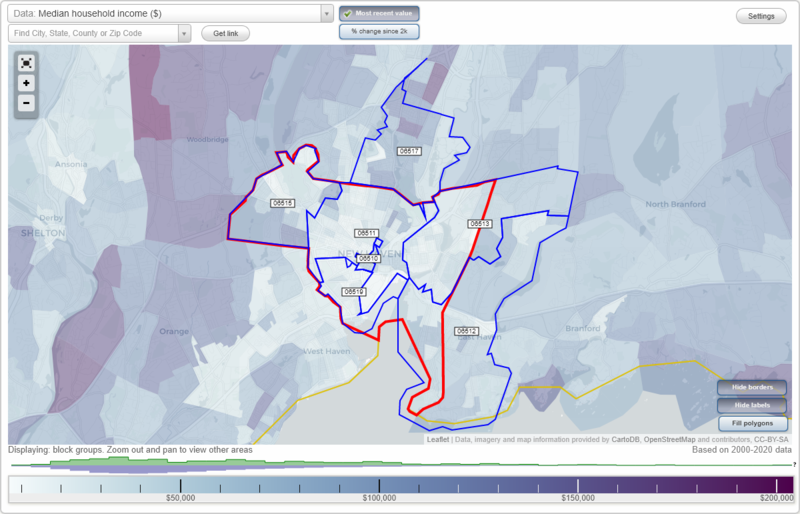

New Haven Connecticut Ct Zip Code Map Locations Demographics List Of Zip Codes

House Senate Unanimously Approve Ct Gas Tax Holiday

400 000 Homes In Texas Minnesota And Connecticut The New York Times

Property Tax Deduction A Guide Rocket Mortgage

Hudson County Property Tax Getjerry Com

New Haven Museum Hamilton Park

2420 22nd Avenue Northeast Hickory Nc 28601 Compass

What Does Next Year S Tax Bill Look Like For Chicago Homeowners Mansion Global

Who Rules America Who Really Ruled In Dahl S New Haven

582 New Haven Rd Se Floyd Va 24091 Loopnet

As Home Sale Prices Surge A Tax Bill May Follow The New York Times

New Haven To Allow Property Tax Pre Payments Following Trump Tax Plan

Death Taxes And Ivory Towers A Story About Yale University And The Untenable Ties To Its Hometown Of New Haven Connecticut The Business Journals